Checklist

Checklist

The 10-Point Checklist Before Applying for any IPO

Don’t gamble with your capital. Use this professional 10-point framework to evaluate every IPO before the subscription opens.

Expert insights on Mainboard and SME IPO trends.

Evaluating Bharat Coking Coal Limited’s market dominance and January 2026 IPO potential.

Checklist

Checklist

Don’t gamble with your capital. Use this professional 10-point framework to evaluate every IPO before the subscription opens.

Upcoming IPO

Upcoming IPO

Reviewing the final SME IPO of 2025: Modern Diagnostic & Research Centre.

Education

Education

A comprehensive guide on the different ways to check your IPO allotment status online.

Education

Education

A guide to understanding the difference between Offer for Sale and Fresh Issue in an IPO.

Upcoming IPO

Upcoming IPO

Analysis of Crystal Crop Protection’s DRHP filing and its market position in agritech.

Open IPO

Open IPO

Analyzing the strong demand and industrial moat of Apollo Techno Industries.

Education

Education

Educational guide on the reasons behind high listing gains in the SME segment.

Open IPO

Open IPO

Current subscription data and financial review for the Admach Systems SME IPO.

Analysis

Analysis

Subscription review and allotment guide for Dachepalli Publishers IPO.

GMP Update

GMP Update

Checking the allotment and 100% GMP status of Shyam Dhani Industries.

Analysis

Analysis

Comparing the subscription and financial health of Nanta Tech and Admach Systems.

Education

Education

Step-by-step instructions on checking IPO allotment status for the latest December listings.

GMP Update

GMP Update

An analysis of the factors driving IPO Grey Market Premium volatility at the end of 2025.

Education

Education

A guide to understanding anchor and promoter lock-in periods and their impact on stock price.

Education

Education

Explaining the impact of SEBI’s confidential filing rules on the 2026 IPO market.

Open IPO

Open IPO

Reviewing Bai-Kakaji Polymers’ expansion plans and its value proposition in the packaging sector.

Analysis

Analysis

A look at how Shyam Dhani Industries became the most subscribed SME IPO with 988x bids.

Analysis

Analysis

A sector-wise guide to the most promising SME IPOs coming in early 2026.

Analysis

Analysis

Evaluating the impact of Swiggy’s 2026 lock-in expiry on its share price and valuation.

Analysis

Analysis

Evaluating the financial recovery and 2026 roadmap of Suraj Estate Developers.

Education

Education

How confidential DRHP filings are changing the 2026 IPO landscape for tech startups.

Education

Education

Exploring the rise of service robotics and automation in the 2026 IPO market.

Analysis

Analysis

Check your Gujarat Kidney IPO allotment status and understand the listing day strategy.

Upcoming IPO

Upcoming IPO

A preview of the Modern Diagnostic & Research Centre IPO opening Dec 31.

Education

Education

A troubleshooting guide for UPI and ASBA payment errors in IPO applications.

Analysis

Analysis

Final day subscription status and long-term outlook for Bai-Kakaji Polymers.

Education

Education

Explaining the recent SEBI changes that make it easier for investors to manage their securities.

Analysis

Analysis

Subscription status and future outlook for the EPW India SME IPO.

Analysis

Analysis

Subscription review and allotment status for the high-demand Dhara Rail IPO.

Upcoming IPO

Upcoming IPO

A comprehensive preview of the Modern Diagnostic & Research Centre IPO.

Analysis

Analysis

Checking the allotment status and listing day expectations for Dachepalli Publishers.

Education

Education

Explaining how anchor investors influence IPO subscription and market sentiment.

Analysis

Analysis

Evaluating MobiKwik’s transformation from a payment wallet to a credit-led fintech.

Open IPO

Open IPO

Reviewing E to E Transportation’s railway infra business and its IPO pricing.

Upcoming IPO

Upcoming IPO

A preview of the Bharat Coking Coal IPO and its impact on the steel industry.

Education

Education

A step-by-step guide for retail investors to analyze an IPO prospectus.

Upcoming IPO

Upcoming IPO

How Flipkart’s move back to India simplifies its path to a $70 billion IPO in 2026.

Education

Education

How SEBI’s T+3 listing mandate has improved liquidity and speed for IPO investors.

Business

Business

Essential tips for launching and growing your small business.

Open IPO

Open IPO

Analyzing the 83% GMP and railway infrastructure moat of E to E Transportation.

GMP Update

GMP Update

Latest news on E to E Transportation IPO GMP and listing gain predictions.

Currently open for subscription, E to E Transportation is riding the wave of India's railway modernization. This update details the rising GMP, subscription status on Day 2, and why this system integrator is attracting heavy HNI interest.

China Market

China Market

China’s markets snap a winning streak just before the holiday break, ending 2025 as one of the best-performing regions globally. This blog details the Shanghai Composite's recovery and the impact of "proactive" fiscal policies.

Open IPO

Open IPO

Sundrex Oil Company makes its debut on the NSE SME platform today, December 30. This update breaks down the B2B lubricant manufacturer's flat GMP status and whether its strong 112% profit growth can overcome the lack of listing-day buzz.

Open IPO

Open IPO

As the final mainboard IPO of 2025 lists today, December 30, all eyes are on Gujarat Kidney & Super Speciality. This blog analyzes the "flat" listing sentiment despite a 5x subscription and the company's long-term healthcare expansion plans.

US Markets

US Markets

Wall Street finishes 2025 within sight of record highs despite a final-week pull-back. This update covers the S&P 500's double-digit annual gains and the impact of the Federal Reserve's recent pivot.

GMP Update

GMP Update

Following a massive 526x subscription, E to E Transportation has finalized its allotment. This blog covers the strong 83% GMP and what investors should expect as the stock debuts on the NSE SME platform on January 2.

Open IPO

Open IPO

Opening for its third day of subscription today, Modern Diagnostic and Research Centre is testing investor appetite for the healthcare diagnostic sector. This blog covers the subscription trends and the firm's expansion into North India.

Open IPO

Open IPO

Victory Electric Vehicles IPO: Check IPO dates, issue size, price, lot size, financials, GMP, business overview and expert investment outlook.

Analysis

Analysis

Moving toward a mid-January launch, Fractal Analytics is poised to be India's first major AI-focused listing. This blog details the ₹4,900 crore issue and what it means for the Indian tech ecosystem.

Open IPO

Open IPO

Opening today, January 6, Gabion Technologies is bringing the "Infrastructure Safety" theme to the market. This blog covers the impressive 37% Grey Market Premium (GMP) and the company’s niche in rockfall protection and slope stabilization.

Education

Education

Learn what Grey Market Premium (GMP) actually means and how you can use it to estimate the listing price of upcoming IPOs like Bharat Coking Coal.

Open IPO

Open IPO

Defrail Technologies Limited, a specialized manufacturer of rubber and polymer-based components, is launching its ₹13.77 crore SME IPO. This post explores the company’s business model—including its role as an RDSO-approved vendor for Indian Railways—its financial health, and the key details investors need to know before the bidding window closes on January 13, 2026.

Open IPO

Open IPO

Amagi Media Labs, a global leader in cloud-native SaaS for the media and entertainment industry, is launching its ₹1,789 crore IPO. This post breaks down the company’s strategic decision to price the issue below its last private valuation, its recent turn toward profitability, and the essential details for investors ahead of the January 13 opening.

Open IPO

Open IPO

Narmadesh Brass Industries, a Jamnagar-based manufacturer of brass billets, rods, and components, has launched its ₹44.87 crore SME IPO. This post dives into the company’s "integrated manufacturing" model, its financial growth from FY23 to FY25, and the key bidding details for investors looking at the industrial metal sector.

Open IPO

Open IPO

Indo SMC Limited, an Ahmedabad-based manufacturer of composite electrical enclosures and components, is launching its ₹91.95 crore SME IPO. With a massive 395% revenue jump in FY25 and backing from ace investor Ashish Kacholia, this post explores if the company's "Sheet Moulding Compound" technology is a winning bet for investors.

Open IPO

Open IPO

Armour Security India Limited, a two-decade-old player in the private security and facility management space, has launched its ₹26.51 crore SME IPO. This post details the company’s expansion into 13+ states, its recent surge in PAT margins, and the key financial metrics you need to know before the subscription window closes on January 19, 2026.

Open IPO

Open IPO

GRE Renew Enertech Limited, a Mehsana-based solar EPC and LED lighting player, is set to launch its ₹39.56 crore IPO. This post explores the company’s dual business model (CAPEX and RESCO), its financial track record with over 61 MW of projects executed, and why this "Green Energy" issue is catching the eye of D-Street investors.

Open IPO

Open IPO

Avana Electrosystems Limited, a Bengaluru-based manufacturer of specialized power system protection equipment, has launched its ₹35.22 crore SME IPO. This post covers the company’s strong financial trajectory, its role in India’s power infrastructure, and critical investment details before the subscription closes on January 14, 2026.

Open IPO

Open IPO

Shadowfax Technologies, the Flipkart-backed logistics disruptor, is launching its ₹1,907 crore IPO. This post explores the company’s recent "turnaround" into profitability, its massive gig-worker network covering 14,700+ pin codes, and the critical financial details you need to know before the bidding window closes on January 22, 2026.

Open IPO

Open IPO

Aritas Vinyl Limited, a manufacturer of high-tech artificial leather and PVC-coated textiles, has launched its ₹37.52 crore SME IPO. This post breaks down the company’s impressive 4x profit growth over two years, its export reach across 5+ countries, and the key financial metrics you need to evaluate before the bidding window closes on January 20, 2026.

Open IPO

Open IPO

Digilogic Systems Limited, a Hyderabad-based provider of advanced Automated Test Equipment (ATE) and Electronic Warfare simulators for the defence and aerospace sectors, has launched its ₹81.01 crore SME IPO. This post breaks down the company’s massive 238% profit growth in FY25, its "Kacholia-style" growth metrics, and the essential bidding details you need before the issue closes on January 22, 2026.

Open IPO

Open IPO

Hannah Joseph Hospital Limited, a Madurai-based tertiary care specialist in Neurosciences and Cardiac care, has launched its ₹42 crore SME IPO. This post dives into the hospital's expansion plans for a new Radiation Oncology Centre, its consistent profit growth (71% PAT increase in FY25), and the critical investment details for the bidding period ending January 27, 2026.

Open IPO

Open IPO

Shayona Engineering Limited, a Vadodara-based manufacturer specializing in precision castings and the newly launched "Shayona Pipe" vertical, is out with its ₹14.86 crore SME IPO. This post analyzes the company's 52% CAGR revenue growth, its expansion into HDPE/PVC pipes, and the key financial metrics for investors looking to bid before January 27, 2026.

Open IPO

Open IPO

Accretion Nutraveda Limited, a Gujarat-based healthcare manufacturer specializing in over 400 Ayurvedic and nutraceutical formulations, is launching its ₹24.77 crore SME IPO. This post breaks down the company’s massive revenue growth, its global footprint across 20+ countries, and the essential bidding details for investors looking to participate between January 27 and January 30, 2026.

Upcoming IPO

Upcoming IPO

NFP Sampoorna Foods Limited, a Rajasthan-based processor of premium cashews, almonds, and makhana, is launching its ₹24.53 crore SME IPO. This post details the company’s impressive 40.9% ROCE, its direct procurement network from Africa and Bihar, and the key financial metrics you need to evaluate before the subscription window opens on January 27, 2026.

Open IPO

Open IPO

Kasturi Metal Composite Limited, a specialized manufacturer of steel fibers and steel wool for critical infrastructure, is concluding its ₹17.61 crore SME IPO today. This post provides the final subscription trends, a deep dive into the company's aggressive capacity expansion, and the crucial listing strategy for investors ahead of its February 3, 2026 debut.

Open IPO

Open IPO

Hannah Joseph Hospital Limited, a premier neurology and multi-specialty healthcare provider in South Tamil Nadu, is concluding its ₹42 crore SME IPO today. This post provides a final look at the subscription trends, the hospital's ambitious expansion into radiation oncology, and the essential timelines for allotment and listing on January 30, 2026.

Open IPO

Open IPO

Shayona Engineering Limited, a diversified manufacturer of precision castings and piping systems, has concluded its bidding window today. With a fresh issue size of ₹14.86 crore and a focus on industrial automation and infrastructure, this blog analyzes the final subscription trends, financial growth, and what investors should expect for the listing on January 30, 2026.

Upcoming IPO

Upcoming IPO

CKK Retail Mart Limited, a key distributor of packaged agro-commodities and branded beverages, is launching its ₹88.02 crore SME IPO. This post breaks down the company’s massive 100% revenue growth in FY24, its expansion into the "FruitzzzUp" juice brand, and the key financial metrics you need to evaluate before the bidding window opens on January 30, 2026.

Open IPO

Open IPO

Kanishk Aluminium India Limited, a Jodhpur-based manufacturer of aluminium extrusions and the name behind the premium "Baari" brand, is currently live with its ₹29.20 crore IPO. With the bidding closing tomorrow, January 30, this post analyzes the company's transition to a debt-free balance sheet, its growing presence in the solar and architectural sectors, and the current flat GMP status.

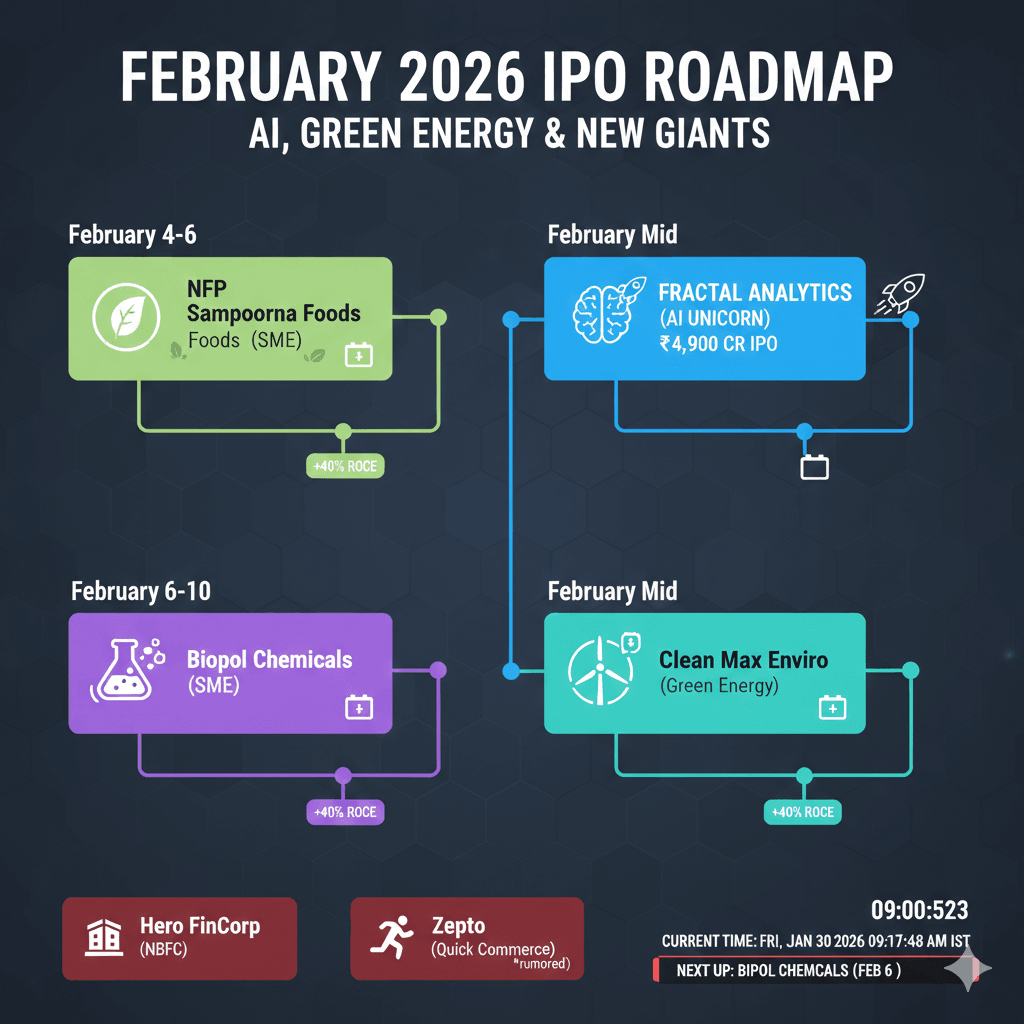

Upcoming IPO

Upcoming IPO

February 2026 is shaping up to be a historic month for the Indian stock market. While January was dominated by SMEs, February is the month where the "Heavyweights" are expected to take the stage.

Open IPO

Open IPO

Msafe Equipments Limited, a leader in aluminum scaffolding and height-safety solutions, is currently live with its ₹66.42 crore IPO. With the bidding ending tomorrow, January 30, this post breaks down the company’s impressive 48% revenue growth, its expansion into a new Greater Noida facility, and the current Grey Market Premium (GMP) as it targets a listing on the BSE SME platform.

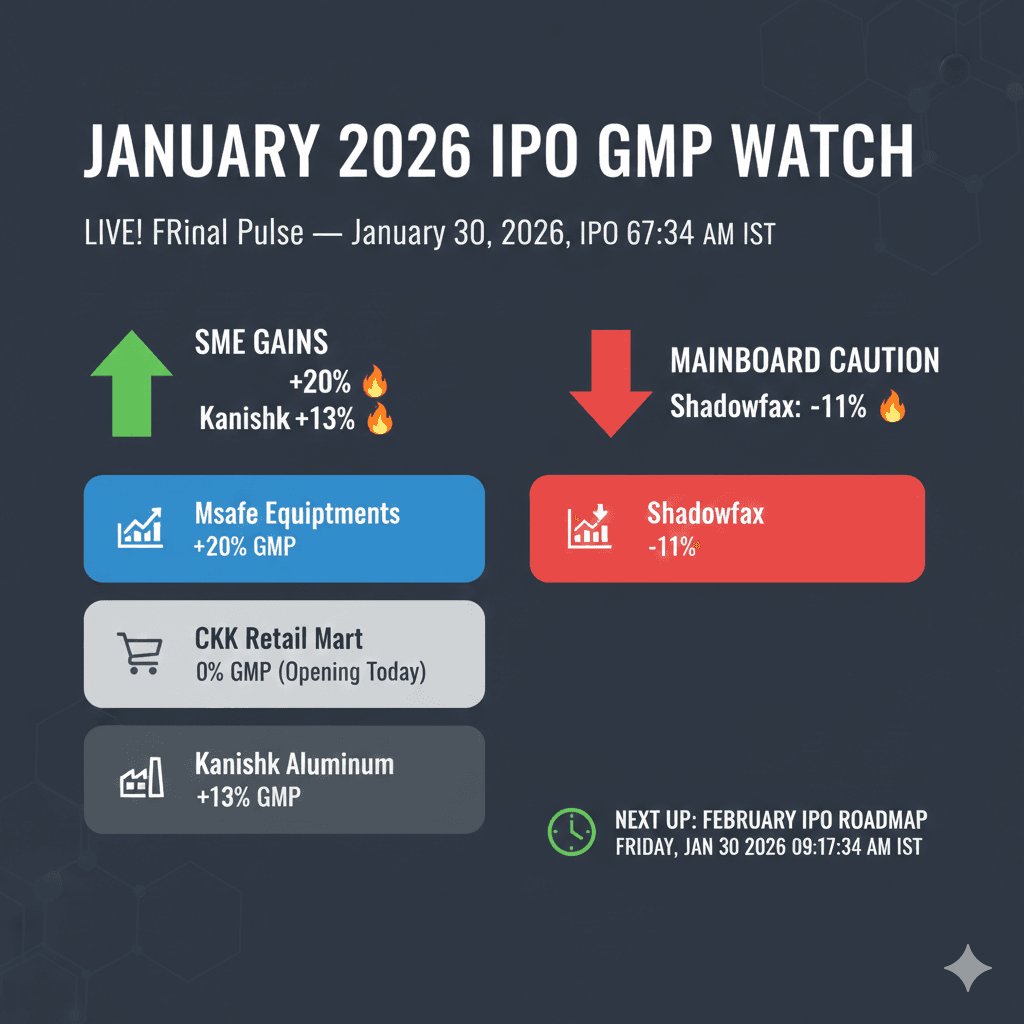

Upcoming IPO

Upcoming IPO

The Indian primary market is concluding January 2026 with a fascinating split in investor sentiment.

Analysis

Analysis

The final week of January 2026 has been a roller coaster for IPO investors. While the Shadowfax Technologies Mainboard IPO dominated headlines, its listing on January 28 told a cautionary tale.

Open IPO

Open IPO

Biopol Chemicals Limited, a leading manufacturer of specialty chemicals for textiles, home care, and agriculture, is launching its ₹31.26 crore SME IPO on February 6, 2026. This blog breaks down the company’s strong financial trajectory, its transition from the legacy "United Chemical Company," and the key risks and rewards for investors looking at the chemical sector.

Open IPO

Open IPO

Brandman Retail Limited, a premier distributor of global athleisure brands like New Balance and Salomon, is launching its ₹86.09 crore SME IPO tomorrow, February 4, 2026. With an asset-light model and a massive 153% jump in profit, this post explores the company’s "Sneakrz" multi-brand strategy and whether the ₹2.81 lakh entry price is worth the stride.

Upcoming IPO

Upcoming IPO

Grover Jewells Limited, a Delhi-based wholesale gold jewellery powerhouse, is launching its ₹33.83 crore IPO on February 4, 2026. With a massive revenue jump in FY25 and a footprint spanning 20 states, this blog explores whether the company's aggressive pricing and specialized manufacturing can deliver long-term value to investors.

Open IPO

Open IPO

Aye Finance, a prominent NBFC backed by Google’s parent company Alphabet (via CapitalG) and Elevation Capital, is set to open its ₹1,010 crore IPO on February 9, 2026. This blog covers the fixed price band of ₹122–₹129, the company’s "cluster-based" lending model, and the latest Grey Market Premium (GMP) signals.

Open IPO

Open IPO

PAN HR Solution Limited, a specialized B2B manpower provider with over 10,000 personnel deployed nationwide, has launched its ₹17.04 crore SME IPO. With a price band of ₹74 to ₹78, this blog analyzes the company’s transition to a high-margin "Pay and Collect" model, its 99% revenue dependency on top clients, and the current flat GMP status.

Open IPO

Open IPO

NFP Sampoorna Foods Limited, a Delhi-based processor of premium dry fruits including cashews, almonds, and makhana, recently concluded its ₹24.53 crore IPO. With a strong presence in both B2B and B2C channels (Amazon, Flipkart, Blinkit), this blog analyzes the company’s recent 55% revenue growth and the key timelines for allotment and listing on February 11, 2026.

Open IPO

Open IPO

The ₹1,010 crore Aye Finance IPO concludes its public bidding today, February 11, 2026. Backed by Alphabet (Google) and marquee global funds, the IPO has seen a cautious start with a flat GMP. This update provides the live Day 3 subscription trends, latest financials (H1 FY26), and the critical listing timelines for February 16.

Open IPO

Open IPO

Fractal Analytics, the first pure-play AI powerhouse to debut on Dalal Street, is concluding its ₹2,834 crore mainboard IPO today, February 11, 2026. This post provides the critical Day 3 subscription update, the current "soft" GMP trends, and the strategic outlook for investors before the stock lists on February 16.

Upcoming IPO

Upcoming IPO

Backed by the legendary P.N. Gadgil & Sons, PNGS Reva Diamond Jewellery is set to launch its ₹380 crore IPO on February 24, 2026. With a focus on "Affordable Luxury" and plans to open 15 new exclusive stores, this blog breaks down the ₹367–₹386 price band, the company's 40% profit growth, and why the grey market is already buzzing.

Upcoming IPO

Upcoming IPO

Latur-based Yashhtej Industries is launching its ₹88.88 crore SME IPO today, February 18, 2026. With a phenomenal revenue surge of over 400% in FY25 and a strategic move into solar power, this blog explores the company’s "Fixed Price" offering and whether its 14x P/E ratio makes it a value buy for retail investors.

Upcoming IPO

Upcoming IPO

Gaudium IVF & Women Health Limited is set to create history with its ₹165 crore IPO opening for public bidding on February 20, 2026. With a strong 41% ROE and a unique hub-and-spoke model across 30+ locations, this blog covers the ₹75–₹79 price band, the high-margin fertility sector outlook, and today’s critical anchor investor activity.

Upcoming IPO

Upcoming IPO

Shree Ram Twistex, a specialized B2B cotton yarn manufacturer from Gujarat, is set to launch its ₹110.24 crore Mainboard IPO on February 23, 2026. With a focus on high-margin "Eli Twist" yarns and a massive pivot toward 100% captive renewable energy, this blog breaks down the ₹95–₹104 price band and the company’s staggering 22% profit growth.

Upcoming IPO

Upcoming IPO

Clean Max Enviro Energy, the preferred green partner for giants like Amazon, Google, and Apple, is launching its ₹3,100 crore IPO on February 23, 2026. With a massive 2.54 GW operational capacity and a successful turnaround to profitability in FY25, this blog breaks down the ₹1,000–₹1,053 price band, the high-profile backing by Brookfield, and what the current grey market trends suggest for investors.

Upcoming IPO

Upcoming IPO

Manilam Industries, a prominent manufacturer of decorative laminates and plywood, is launching its ₹39.95 crore SME IPO on February 20, 2026. With a strong ROE of 24.8% and a massive product portfolio of over 1,000 designs, this blog explores the ₹65–₹69 price band and the company's aggressive expansion plans in the building materials sector.

Upcoming IPO

Upcoming IPO

SaaS pioneer Mobilise App Lab Limited is set to launch its ₹20.10 crore NSE SME IPO on February 23, 2026. Specializing in AI-driven ERP and IoT solutions for education and facility management, the company boasts a massive 48.3% EBITDA margin and a revenue CAGR of over 50%. This blog covers the ₹75–₹80 price band and its strategic focus on infrastructure and talent hiring.